| | | | | | | |

|---|

Title of Class | | Name and Address

of Beneficial Owner | | Amount and Nature of

Beneficial Ownership | | Percent

of Class1 | |

|---|

Common Stock | | BlackRock, Inc.

55 East 52nd Street

New York, New York 10055 | | 1,297,7271,288,939

| 2 | 8.428.48

| % | Common Stock | | Dimensional Fund Advisors, L.P.

6300 Bee Cave Road Building One

Austin, Texas 78746 | | 1,143,1201,090,507

| 3 | 7.427.18

| % |

| 1 | The denominator used to calculate these percentages is the number of shares issued and outstanding as of March 31, 2021.2023. However, the numerator is the number of shares reported in SEC filings as of December 31, 2020.2022. |

| 2 | Represents shares reported on a Schedule 13G as of December 31, 20202022 filed with the SEC by BlackRock, Inc. BlackRock, Inc. has sole voting power with respect to 1,233,7631,196,682 of such shares and sole dispositive power with respect to all 1,297,7271,288,939 shares. |

| 3 | Represents shares reported on a Schedule 13G as of December 31, 20202022 filed with the SEC by Dimensional Fund Advisors, L.P. (“Dimensional”). Dimensional has sole voting power with respect to 1,097,4901,070,060 of such shares and sole dispositive power with respect to all 1,143,1201,090,507 shares. Dimensional furnishes investment advice to four investment companies registered under the Investment Company Act of 1940, and serves as investment manager or sub-adviser to certain other commingled funds, group trusts and separate accounts (such investment companies, trusts and accounts, collectively referred to as the “Funds”). All securities reported in the table are owned by the Funds, and Dimensional disclaims beneficial ownership of such securities. |

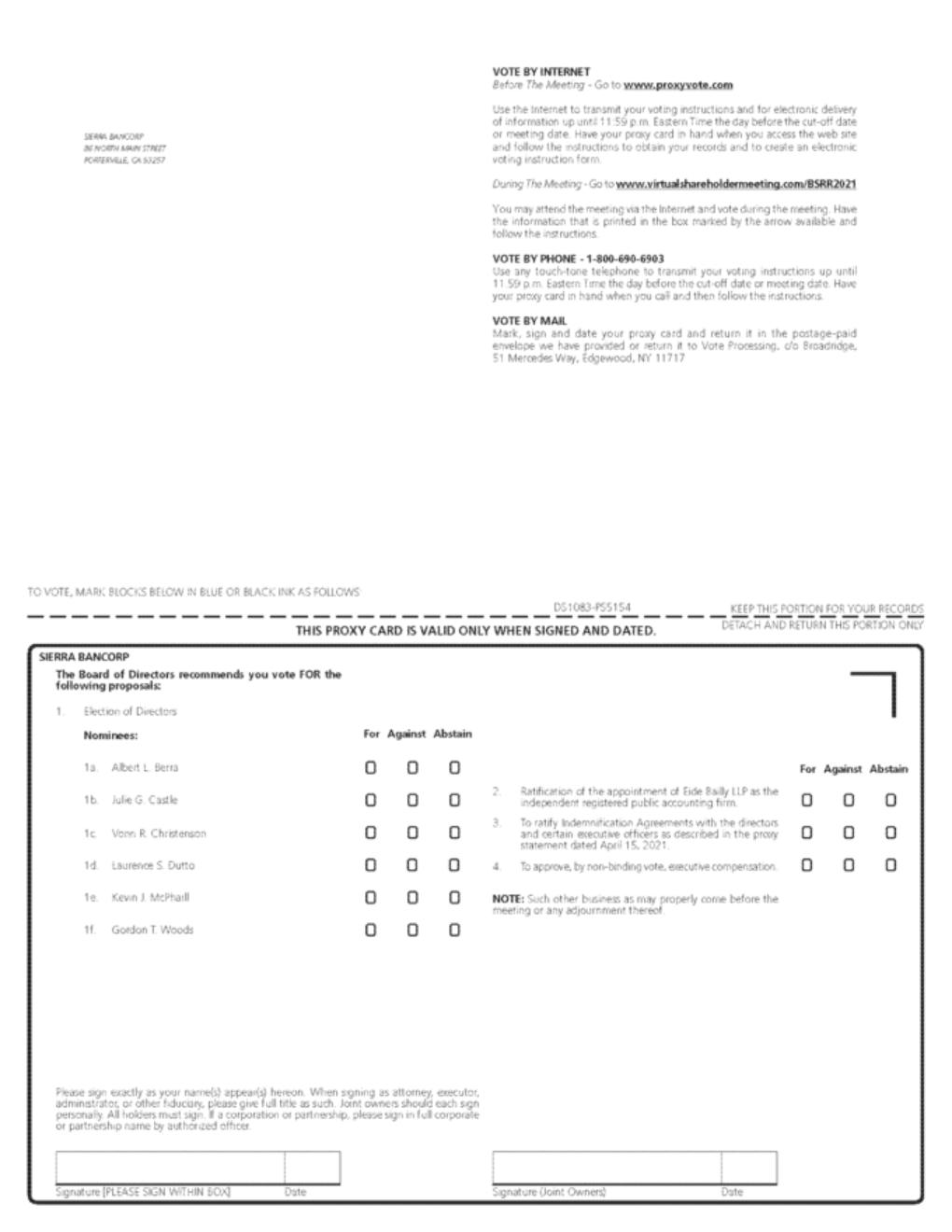

DELINQUENT SECTION 16(a) REPORTS There were nowas a single late filingsfiling of reportsa report required byunder Section 16(a) of the Exchange Act by directors, officers, beneficial owners of more than ten percent of Company’s common stock during 2020. One director gifted 14,3002022. Mr. Boyle filed a late Form 4 with respect to the net settlement of shares in December 2020 and the Form 5 report for such gift is due 45 days after the company’s fiscal year ends, or February 14, 2021. The Form 5of stock related to such 2020 gift of shareshis restricted stock vesting on March 1, 2022. Due to an inadvertent oversight, Mr. Boyle’s Form 4 was not filed until February 22, 2021 upon the discovery of the missed filing after the submission of the annual director questionnaire.one day late on March 4, 2022. RELATED PARTY TRANSACTIONS Some of our executive officers and directors and the companies with which they are associated have been customers of, and have had banking transactions with, Bank of the Sierra (the “Bank”) in the ordinary course of the Bank’s business since January 1, 2020,2022, and the Bank expects to continue to have such banking transactions in the future. All loans and commitments to lend included in such transactions were made in the ordinary course of business and on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable loans with persons not related to the Bank, and in the opinion of the Board of Directors, did not involve more than the normal risk of repayment or present any other unfavorable features. In addition, a company with which Michele Gil, one of our director nominees, has been associated and partly owns received payments from the Company in the ordinary course of the Bank’s business since January 1, 2022. These payments were related to executive recruiting activities and amounted to $227,600 in the ordinary course of the Bank’s business during the past three years. Since Ms. Gil’s nomination as a potential director of the Company, this company has not been retained for any additional search services. Ms. Gil’s approximate interest in these payments is estimated to be $113,800 based solely on her percentage of ownership. The engagement of this company for search services predated Ms. Gil being considered a potential nominee for director. PROPOSAL 2 APPROVAL OF 2023 EQUITY-BASED COMPENSATION PLAN Introduction On March 17, 2023 the Board of Directors approved and adopted the Company’s 2023 Equity Compensation Plan (the “2023 Plan”) effective May 24, 2023 subject to the approval of the Company’s Shareholders. The 2023 Plan will replace the Company’s 2017 Stock Incentive Plan (the “2017 Plan”). The number of shares authorized to be issued remained relatively unchanged under the 2023 Plan as those remaining under the 2017 Plan. The 2023 Plan provides for the issuance of various types of equity awards, including options, stock appreciation rights, restricted stock awards, restricted share units, performance share awards, dividend equivalents, or any combination thereof. Such equity awards may be granted to officers and employees as well as non-employee directors, which awards may be granted on such terms and conditions as are established by the Board of Directors or the Compensation Committee in its discretion. The 2023 Plan also provides for the issuance of both “incentive” and “non-qualified” stock options to officers and employees and for the issuance of “non-qualified” stock options to non-employee directors. The following description is intended to highlight and summarize the principal terms of the 2023 Plan. For further information, shareholders may refer to the copy of the 2023 Plan which is attached as an exhibit to this filing. A copy of the 2023 Plan is also available for inspection at the Company’s administrative office. Purpose The 2023 Plan is intended to (i) encourage selected employees and non-employee directors of the Company to acquire a proprietary and vested interest in the growth and performance of the Company; (ii) generate an increased incentive for participants to contribute to the Company's future success and prosperity, thus enhancing the value of the Company for the benefit of all shareholders; and (iii) enhance the ability of the Company and its subsidiaries to attract and retain individuals of exceptional talent upon whom, in large measure, the sustained progress, growth and profitability of the Company depend. Shares Subject to the 2023 Plan Upon approval of the 2023 Plan the approximately 356,000 shares remaining shares that are unissued under the 2017 Plan will expire. The maximum number of shares to be issued under the 2023 Plan is 360,000 shares of our authorized but unissued common stock, subject to adjustment for stock splits and dividends. This maximum number covers all types of equity awards to be granted under the 2023 Plan. While the 2017 Plan will expire upon the approval of the 2023 Plan, the restricted shares and options granted and still outstanding under the 2017 Plan will not be affected. As of this filing there are 215,600 remaining unexercised options and 279,381 shares of unvested restricted stock outstanding under the 2017 Plan. The 360,000 shares available for issuance under the 2023 Plan equals 2.4% of the number of shares of our common stock issued and outstanding as of March 31, 2023. As the number of authorized shares remaining under the 2017 Plan are carried over to the 2023 Plan, no additional dilution is expected from the 2017 Plan previously approved by shareholders. All shares subject to any option which remain unpurchased at the expiration of such option, or shares subjected to restricted stock awards which are forfeited or settled in cash by the participant, become available again for purposes of the 2023 Plan. Administration of the 2023 Plan The 2023 Plan provides that it shall be administered by the Compensation Committee with respect to all option grants or other awards to the Company’s Named Executive Officers (unless the Board, in its discretion shall elect to grant or modify any awards to Named Executive Officers which are not intended to be exempt compensation pursuant to Section 162(m)), and otherwise by the Board of Directors. The Board or the Compensation Committee shall select from the eligible class and determine the individuals who shall receive restricted stock awards or options. Eligibility All directors, officers, and employees of the Company and its subsidiaries will be eligible for participation in the 2023 Plan. However, only officers or employees of the Company are eligible to receive incentive stock options (“Incentive Options”). (See “Federal Income Tax Consequences – Incentive Stock Options.”) Directors who are not also employees or officers are eligible to receive only non-qualified stock options (“Non-Qualified Options”) or restricted stock awards. There are currently 62 employees and eleven non-employee directors with outstanding unvested or unexercised awards under the 2017 Plan. Historically, the Company has limited the grant of equity-based compensation awards to officers and directors, and based on this historical practice, the current class of likely eligible participants would consist of approximately 175 persons, including eleven non-employee directors and five executive officers. Restricted Stock Awards Restricted stock awards consist of non-transferable shares of our common stock, for no cash consideration or for such amount as the Board or the Compensation Committee in its discretion shall determine, either alone or in addition to other awards granted under the 2023 Plan. The provisions of restricted stock awards need not be the same with respect to each recipient or each award. The Board or the Compensation Committee may provide for the lapse of the transfer restrictions (also referred to as the vesting of the award) over a period of not more than 10 years provided, however, that in no event shall any installment of any restricted stock award become vested less than one year from the grant date. The Board or the Compensation Committee may accelerate or waive such restrictions, in whole or in part, based on service, performance or other criteria determined by the Board or the Compensation Committee. The Board or the Committee may also provide that the vesting dates for an award will be accelerated upon the subsequent occurrence of such event (e.g., early retirement of the recipient) as the Board or the Committee may specify. Awards may also be “performance-based,” so that the vesting or lapse of restrictions is conditioned upon the attainment of specified company, group or division performance goals or other criteria, which need not be the same for all participants. Except as otherwise determined by the Board or the Compensation Committee, upon termination of employment or service as a director for any reason during the restriction period, any portion of a restricted stock award still subject to restriction will be forfeited by the participant and reacquired by the Company. The Board or the Compensation Committee shall determine at the time of granting any restricted stock award whether the recipient will have any voting or dividend rights with respect to the shares prior to the lapse of the restrictions, except that no such dividends or distributions shall be paid with respect to any such shares until the shares have vested, and the recipient shall not be entitled to any such distributions in the event the shares are forfeited. Qualifying Performance Criteria. Performance Awards vest upon the attainment of performance criteriarelating to one or more business criteria within the meaning of Section 162(m) of the Code, as determined by the Compensation Committee (“the Committee”) in its sole discretion at the Award Date, including but not limited to: return on average common shareholders’ equity; return on average equity; total shareholder return; stock price appreciation; efficiency ratio (other expense as a percentage of other income excluding gains and losses plus net interest income); net operating expense (other income less other expense); earnings per diluted share of Common Stock; per share earnings before transaction-related expense; per share earnings after deducting transaction-related expense; return on average assets; ratio of nonperforming to performing assets; ratio of loans to deposits; deposit composition; loan growth; deposit growth; return on an investment in an affiliate; net interest income; net interest margin; ratio of common equity to total assets; regulatory compliance metrics; and customer service metrics. Performance Criteria may be stated in absolute terms or relative to comparison companies or indices to be achieved during a period of time. Any Performance Criteria may be used to measure the performance of the Company as a whole or any business unit of the Company. Any Performance Criteria may include or exclude extraordinary items such as extraordinary, unusual and/or non-recurring items of gain or loss, gains or losses on the disposition of a business, changes in tax or accounting regulations or laws, or the effects of a merger or acquisition. Performance Criteria generally shall be established by the Committee and shall be derived from the Company’s audited financial statements, including footnotes, the Management’s Discussion and Analysis section of the Company’s annual report, or any other measure of performance desired by the Committee. The Committee may not in any event increase the amount of compensation payable to a covered employee, as defined in Section 162(m) of the Code, upon the satisfaction of any Performance Criteria. Adjustments Upon Changes in Capitalization In the event of (i) a change in corporate capitalization, a corporate transaction or a complete or partial corporate liquidation, or (ii) any extraordinary gain or loss or other event that is treated for accounting purposes as an extraordinary item under generally accepted accounting principles, or (iii) any material change in accounting policies or practices affecting the Company and/or the Performance Criteria or targets, then, to the extent any of the foregoing events (or a material effect thereof) was not anticipated at the time the targets were set, the Committee may make adjustments to the Performance Criteria and/or targets, applied as of the date of the event, and based solely on objective criteria, so as to neutralize, in the Committee’s judgment, the effect of the event on the applicable Performance-Based Award. Change in Control A Change in Control shall be deemed to have occurred if after the effective date of the 2023 Plan, (i) a consolidation or merger of the Company is consummated where the Company is not the continuing or surviving corporation, other than a merger of the Company where the holders of the Company’s common stock immediately prior the merger have substantially the same proportionate ownership of common stock of the surviving entity immediately following the merger, (ii) any sale, lease, exchange or transfer of all or substantially all of the assets of the Company, (iii) the shareholders of the Company approve a plan to liquidate or dissolve the Company and/or a banking subsidiary; (iv) certain “persons” as defined in the Exchange Act become the beneficial owner of 25% or more of the combined voting power of the Company’s then outstanding securities having the right to vote in the election of directors; (v) if current directors during a period of two consecutive years cease to constitute a majority of the Board of Directors, unless the election of each new director was approved by a vote of at least two-thirds of the directors then still in office who were directors at the beginning of such two-year period, or (vi) any other event required to be reported in response to Item 6€ of Schedule 14A of the Regulation 14A promulgated under the Exchange Act. In the event of a change in control of the Company as defined in the 2023 Plan, the Board shall send notice to each Participant no later than 30 days prior to the expected closing of the Change in Control Event. In such case, each Option and Stock Appreciation Right shall become immediately exercisable and each Restricted Stock Award shall immediately vest free of restrictions. Further, all performance criteria with respect to any award, including each Performance Award Share shall be deemed achieved at target levels and all other terms and conditions met, and such Award shall become immediately payable to the Participant. No awards may be made after the Board of Directors has approved a Change in Control, unless the Change in Control is cancelled or terminated before becoming effective, in which event the Plan shall not terminate, and Awards not exercised while the Change in Control was pending shall resume the status they had prior to the announcement of the Change in Control and delivery of the Notice. Duration of the 2023 Plan The Board of Directors, without further approval of the shareholders, may at any time terminate the 2023 Plan, but such termination shall not adversely affect any options or awards granted prior thereto without the consent of the participant. If the 2023 Plan is not so terminated by the Board of Directors, it will terminate by its own terms on May 24, 2033. Amendment of the 2023 Plan The Board of Directors of the Company reserves the right to suspend, modify or amend the 2023 Plan in whole or part. If any amendment would materially increase the aggregate number of shares or securities that may be issued or materially modifies the requirements as to eligibility for participation, or would otherwise require shareholder approval under applicable law or listing standards, such amendment shall be subject to shareholder approval. New Plan Benefits; Outstanding Options or Awards Under the 2023 Plan As the 2023 Plan will not become effective until May 24, 2023, no restricted stock awards or options have yet been granted thereunder. In addition, because restricted stock awards and options under the 2023 Plan will be granted at the discretion of the Board or the Compensation Committee, it is not possible for the Company to determine and disclose the amount of future restricted stock awards or options that may be granted if the 2023 Plan is approved by the shareholders. Future exercise prices for options granted under the 2023 Plan are also undeterminable because they will be based upon the fair market value of our common stock on the date of grant. Securities Authorized for Issuance under Equity Compensation Plans The following table provides information as of December 31, 2022, with respect to options outstanding and available under both our 2017 Plan and 2007 Plan, which as of that date were the Company’s only equity compensation plans other than an employee benefit plan meeting the qualification requirements of Section 401(a) of the Internal Revenue Code: | | | | | | | | | Plan Category | | Number of Shares to be Issued Upon Exercise of Outstanding Options | | Weighted-Average Exercise Price of Outstanding Options | | Number of Unvested Shares of Restricted Stock Outstanding | | Number of Shares Remaining Available for Future Issuance | The 2007 Plan | | 135,449 | | $21.60 | | - | | - | The 2017 Plan | | 215,600 | | $27.22 | | 279,381 | | 356,420 |

Federal Income Tax Consequences The following summary is a general discussion of certain expected federal income tax consequences arising to optionees or restricted stock award recipients under the 2023 Plan. This summary does not discuss all aspects of federal income taxation which may be relevant to a particular participant subject to special tax treatment under the federal income tax laws and does not discuss any aspect of state, local or foreign tax laws. No assurance can be given that the tax treatments described herein will continue to apply. Incentive Stock Options. No federal income tax is imposed on the optionee upon the grant or exercise of an Incentive Option, except that upon exercise the optionee will recognize alternative minimum taxable income, as described below. Assuming the optionee complies with specified “holding period” requirements imposed by the Code and meets certain other requirements necessary to qualify the option as an Incentive Option, the optionee will be entitled for federal income tax purposes to treat any profit realized upon disposition of the stock as a capital gain rather than as ordinary income, and the Company will not be entitled to a deduction. If all applicable Incentive Option requirements are met, upon exercise the optionee will recognize as alternative minimum taxable income the amount by which the fair market value of the stock upon exercise exceeds the option exercise price. Alternative minimum taxable income forms the basis for the alternative minimum tax, which may apply depending on the amount of the computed “regular tax” of the employee for that year. Under certain circumstances the amount of alternative minimum tax is allowed as a carryforward credit against regular tax liability in subsequent years. If the "holding period" requirements are not met, the optionee will realize compensation taxable as ordinary income rather than capital gain, and the Company may claim a deduction for compensation paid at the same time and in the same amount as the compensation income recognized by the optionee. Capital gains are currently taxed at a lower rate than ordinary income. Non-Qualified Stock Options. No federal income tax is imposed on the optionee upon the grant of a Non-Qualified Option. Upon exercise of a Non-Qualified Option, under present law the optionee will recognize ordinary taxable income (as opposed to a capital gain) and the Company will be entitled to a deduction in the amount by which the fair market value of the stock upon exercise exceeds the option exercise price. Such ordinary income may be subject to the maximum personal income tax rate. In the case of an employee, such income also constitutes "wages" and thus withholding is required under federal law. Upon subsequent disposition of such shares, assuming such shares have been held for long enough to qualify for capital gains treatment, the optionee will recognize capital gain or loss in an amount equal to the difference between the proceeds received upon such disposition and the fair market value of such shares at the time of exercise. As stated above, capital gains are currently taxed at a lower rate than ordinary income. Restricted Stock Awards. No federal income tax is imposed on a recipient at the time shares of restricted stock are granted, nor will the Company be entitled to a tax deduction at that time. Instead, when either the transfer restriction or the forfeiture risk lapses, typically on the vesting date, the recipient will recognize ordinary income in an amount equal to the fair market value of the shares of restricted stock over the amount, if any, paid for such shares. If the individual chooses to make a Special Tax 83(b) election, the spread must be reported as ordinary income and is based on the fair market value of the restricted shares (minus the amount paid for the shares, if any) at the time of the award (rather than at the time of vesting). The election must be made (and filed with the IRS) within 30 days of the award. The holding period for capital gains purposes would begin at the time of the award, and gain made upon a future sale would be capital gain. There would be no immediate tax consequence when the shares vest. However, if an individual who made a Special Tax 83(b) election and paid any required tax in the year of the award were later to forfeit the restricted shares (for example, by leaving the Company before the shares vested), he or she would not would not be entitled to a refund for the taxes paid, but would be able to treat the forfeiture of the stock as a sale of the stock at a (capital) loss. At the time the recipient recognizes ordinary income with respect to shares issued pursuant to a restricted stock award, the Company will be entitled to a corresponding deduction. Section 162(m). Section 162(m) is currently suspended and does not apply. In the event that Section 162(m) becomes applicable, it would render non-deductible to us certain compensation in excess of $1,000,000 received in any year by certain executive officers unless such excess is “performance-based compensation” (as defined in the Internal Revenue Code) or is otherwise exempt from Section 162(m). The availability of the exemption for awards of performance-based compensation depends upon obtaining approval of the 2023 Plan by our shareholders. Assuming shareholder approval, grants of options, restricted stock awards and cash-based awards conditioned on attainment of one or more performance goals set forth in the 2023 Plan may qualify as performance-based compensation and be exempt from Section 162(m). Section 409A. Any deferrals made under the 2023 Plan, including awards granted under the 2023 Plan that are considered to be deferred compensation, must satisfy the requirements of Section 409A of the Internal Revenue Code to avoid adverse tax consequences to participating employees. These requirements include limitations on election timing, acceleration of payments, and distributions. The Company intends to structure any deferrals and awards under the 2023 Plan to meet the applicable tax law requirements. Board of Directors’ Recommendation and Required Vote Approval of the 2023 Plan requires the affirmative vote of a majority of the shares of the Company’s common stock represented and voting at the Meeting. The directors and executive officers of the Company, owning or controlling an aggregate of 1,521,097 voting shares or 11.9% of the Company's outstanding common stock as of the record date for the Meeting, are expected to vote in favor of approval of the 2023 Plan. The directors recognize that they have a personal interest in this matter but they strongly believe that the approval of the 2023 Plan is in the best interests of the Company and its shareholders because they feel that the 2023 Plan will be helpful in enabling the Company to continue to provide meaningful incentives to encourage directors, officers and employees to remain with the Company, and to attract new qualified directors and employees in today's competitive market. Your Board of Directors recommends a vote “FOR” Proposal 2. PROPOSAL 3 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM General The Audit Committee has appointed Eide BaillyRSM US LLP (“Eide Bailly”RSM”) as the independent auditors for the Company for the fiscal year ending December 31, 2021.2023. Eide Bailly LLP (“Eide Bailly”) audited the Company’s financial statements for the fiscal years ended December 31, 20202022 and December 31, 2019.2021. Although not required to do so, the Board of Directors has chosen to submit this proposal to the vote of the shareholders in order to ratify the Audit Committee’s appointment of Eide Bailly.

RSM. It is the intention of the persons named in the Proxy to vote such Proxy “FOR” the ratification of this appointment. If the Company’s shareholders do not ratify the selection, the Audit Committee will reconsider whether to retain Eide Bailly,RSM, but may still retain them. Even if the selection is ratified, the Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that such a change would be in the best interests of the Company and its shareholders. On March 21, 2023, the Company’s Audit Committee approved the dismissal of Eide Bailly as the Company’s Independent Auditor as reported in the form 8-K filing on March 21, 2023. Eide Bailly’s audit reports on the Company’s financial statements as of December 31, 2022 and December 31, 2021 did not contain an adverse or disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principle. During the fiscal years ended December 31, 2021 and December 31, 2022 there have been no “disagreements” (as defined in item 304(a)(1)(iv) of Regulation S-K) with Eide Bailly on any matter related to accounting principles, practices, financial statement disclosure or auditing scope or procedure, which disagreements if not resolved to the satisfaction of Eide Bailly would have caused Eide Bailly to reference thereto in its audit reports on the Company’s financial statements as of December 31, 2022 and December 31, 2021. During the fiscal years ended December 31, 2021 and December 31, 2022 there have been no “reportable events” (as defined in item 304(a)(1)(v) of Regulation S-K). Representatives of Eide Bailly are expected to attend the Meeting. They will have the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions. Fees The aggregate fees billed by Eide Bailly for the fiscal years ended December 31, 20202022 and 2019,2021, were as follows: | | | | | | | | | | 2022 | | 2021 | | Audit fees | | $ | 450,000 | | $ | 417,000 | | Audit related fees1 | | | — | | | — | | Tax fees2 | | | — | | | — | | All other fees | | | — | | | — | | Total | | $ | 450,000 | | $ | 417,000 | |

| | | | | | | | | | 2020 | | 2019 | | Audit fees1 | | $ | 375,000 | | $ | 356,000 | | Audit related fees2 | | | 16,500 | | | 16,500 | | Tax fees3 | | | 44,300 | | | 33,375 | | All other fees | | | — | | | — | | Total | | $ | 435,800 | | $ | 405,875 | |

1 | On July 22, 2019, Eide Bailly acquired the operations and absorbed certain of the professional staff and partners of the Company’s previously appointed independent auditor, Vavrinek, Trine, Day & Company. The 2019 Audit fees include $100,000 paid to Vavrinek, Trine, Day & Company for work performed prior to July 22, 2019, and $256,000 for work performed by Eide Bailly after July 22, 2019. |

2 | For 2020 and 2019, the entire amount is for audit of the employee benefit plan. In 2019, $15,000 was paid to Vavrinek, Trine, Day & Company and $1,500 was paid to Eide Bailly LLP. |

3 | Tax services included preparation of tax returns and tax payment planning services, as well as fees related to other tax advice, tax consulting and planning. |

None of the fees paid to Eide Bailly during 20202022 and 20192021 were paid under the de minimis safe harbor exception from Audit Committee pre-approval requirements. The Audit Committee has concluded that the provision of the non-audit services listed above is compatible with maintaining Eide Bailly’s independence. Board of Directors’ Recommendation and Required Vote The proposal will be ratified if the votes cast favoring the appointment exceed the votes cast opposing it. Your Board of Directors unanimously recommends a vote “FOR” Proposal 2.3. PROPOSAL 3

RATIFICATION OF INDEMNICIATION AGREEMENTS BETWEEN THE COMPANY AND ITS NONEMPLOYEE DIRECTORS AND EXECUTIVE OFFICERS

General

The Company (in this section, “Company” refers to Sierra Bancorp and its subsidiaries collectively) and its directors are aware of the substantial growth in the number of lawsuits filed against corporate directors and officers in connection with their activities in such capacities and in many instances, solely by reason of their status as directors and officers. Further, we recognize that the present state of the law is too uncertain to provide the Company’s directors and officers with adequate and reliable information or guidance with respect to the legal risks associated with their respective position with the Company and those potential liabilities to which they may become personally exposed as a result of performing their various duties on behalf of the Company. It is also recognized that the cost of defending against such lawsuits, whether brought with or without merit, is typically beyond the financial resources of most directors and officers

of the Company. Moreover, it is often the case that the legal risks and potential liabilities, and the threat thereof, associated with defending proceedings filed against the directors and officers of the Company bear no reasonable relationship to the amount of compensation received by the Company’s directors and officers.

Section 317 of the California Corporations Code empowers California corporations to indemnify their directors and officers and further states that the indemnification provided by Section 317, “shall not be deemed exclusive of any other rights to which those seeking indemnification may be entitled under any bylaw, agreement, vote of shareholders or disinterested directors or otherwise, both as to action in an official capacity and as to action in another capacity while holding such office to the extent such additional rights to indemnification are authorized in the articles of the corporation.” Thus, Section 317 does not by itself limit the extent to which the Bank may indemnify persons serving as its directors and officers.

On January 28, 2021, the Board of Directors of the Company adopted Indemnification Agreements (the “Agreements”) with each of its’ non-employee directors: Morris A. Tharp, Susan. M. Abundis, Albert L. Berra, Julie G. Castle, Vonn R. Christenson, Laurence S. Dutto, Robb Evans, James C. Holly, Lynda B. Scearcy, and Gordon T. Woods and each of its’ executive officers: Kevin J. McPhaill, the Company’s President and Chief Executive Officer and director; Christopher G. Treece, the Company’s Executive Vice President and Chief Financial Officer; Hugh Boyle, the Company’s Executive Vice President and Chief Credit Officer; James Gardunio, the Company’s Executive Vice President; Michael W. Olague, the Company’s Executive Vice President and Chief Banking Officer; Jennifer A. Johnson, the Company’s Executive Vice President and Chief Administrative Officer; and Matthew J. Macia, the Company’s Executive Vice President and Chief Risk Officer (collectively, the “Indemnified Parties”). The Agreements are intended to indemnify the Indemnified Parties from and against liability incurred in any proceeding in which he/she is made a party to the proceeding because he/she is a director or officer of the Company, and are further intended to encourage the Indemnified Parties to excel in their respective positions with the Company, which includes making business decisions deemed necessary for the long term success of the Company. Further, the Agreements are necessary for the Company to assume, for itself, liability for those expenses and damages associated with claims against the Indemnified Parties in connection with their services to the Company, without regard to the merit and/or basis of such claims.

The Company has entered into the Agreements with the Indemnified Parties as authorized by the Board of Directors. The shareholders are being asked to ratify this action and approve each of the Agreements. If for any reason the shareholders fail to ratify the Agreements, the Bank does not intend to terminate or otherwise modify the Agreements that it currently has with the Indemnified Parties.

Although neither shareholder approval nor ratification of the Agreements is required by law, the Board believes it is appropriate to submit the Agreements to the Company’s shareholders for ratification because the current directors are parties to, and the beneficiaries of, the rights contained in, and stemming from, the Agreements.

Summary of the Agreements

The following is only intended as a summary of the terms of the Agreements, and the summary is not a substitute for reviewing the entire Agreements, the full text of which is attached to this Proxy Statement as Appendix “A.” The following summary is qualified in its entirety by the actual terms of the Agreements.

Right to Indemnification

Under the Agreements, the Company will indemnify the Indemnified Parties against expenses (including attorneys’ and experts’ fees, judgments, fines, and amounts paid or payable in settlement) actually and reasonably incurred by the Indemnified Parties(“Expenses”) in certain situations. The Agreements divide potential claims against an Indemnified Party into two different categories: (1) claims made by third parties (“Third Party Proceedings”); and (2) claims made by or in the right of the Company (“Derivative Claims”). An example of a Third Party Proceeding would be an individual that slips and falls in the Company’s lobby and then brings a lawsuit against the Company and our CEO that claims the Company and the CEO are both liable for the slip and fall accident. An example of a Derivative Claim would be a lawsuit by one of our shareholders against our board of directors that asserts that the board has violated a duty

owed to the Company, and through that violation has harmed the Company. The Agreements require different things in order for one of the Indemnified Parties to be indemnified in Third Party Proceeding and a Derivative Claim:

Third Party Proceedings. To receive indemnification in a Third Party Proceeding an Indemnified Party must have acted in good faith and in a manner the Indemnified Parties reasonably believed to be in the best interests of the Company. If the matter happens to involve a criminal charge, the Indemnified Party must have believed that his/her conduct was lawful.

Derivative Claims. To receive indemnification in a Derivative Claim an Indemnified Party must meet the threshold for indemnification in a Third Party Proceeding plus two additional requirements. Accordingly, to be eligible for indemnification the Indemnified Party must have acted in good faith and in a manner they reasonably believed to be in the best interest of the Company plus: (1) they must have acted in a manner they believed to be in the best interests of the Company’s shareholders, and (2) any settlement or other disposition of the matter must be done with court approval.

In any proceeding, if the Indemnified Parties are determined to be liable to the Company in the performance of their duty(ies) to the Company, no indemnification shall be made unless a court determines that the Indemnified Parties are entitled to reimbursement for their Expenses.

Limitations on Indemnification

The Company is not obligated to indemnify an Indemnified Party for:

| ● | Any claim or any part of a claim arising out of acts, omissions or transactions for which a director or officer may not be indemnified under California General Corporation Law (“CGCL”) or expenses, penalties or other payments prohibited by Part 359 of the FDIC’s Rules; |

| ● | Any proceeding initiated by the Indemnified Parties, except claims brought by the Indemnified Parties to enforce the Indemnified Parties’ rights under the Agreements, other laws or as required under Section 317 of the CGCL, unless the Board of Directors approved the initiation of such proceeding; |

| ● | Expenses with respect to legal proceedings initiated by the Indemnified Parties if the court determines such proceeding was not brought in good faith or was frivolous; |

| ● | Any Expenses which have been paid directly to or on behalf of the Indemnified Party by an insurance carrier under a director and officer insurance policy maintained by the Company, or any other insurance policy maintained by the Company or the Indemnified Parties; or |

| ● | Expenses and the payment of profits arising from the purchase and sale by the Indemnified Parties of securities in violation of the Securities Exchange Act of 1934, as amended. |

In addition, nothing in the Agreements requires indemnification, reimbursement, or payment by the Company and no Indemnified Partyshall be entitled to demand indemnification, reimbursement, or payment under the Agreements, if and to the extent indemnification, reimbursement, or payment constitutes a "prohibited indemnification payment" within the meaning of Federal Deposit Insurance Corporation Rule 359.1(1)(1).

Determination of Right to Indemnification

Upon receipt of a request for indemnification, the Board of Directors will determine by any of the methods set forth in Section 317(e) of the CGCL whether the Indemnified Parties have acted in a manner which would permit indemnification. If a claim for indemnification is not paid by the Company within ninety (90) days after a written claim is received, then the Indemnified Parties may bring a suit against the Company for indemnification. Unless that lawsuit is dismissed as frivolous or is brought in bad faith, the Indemnified Parties may also receive indemnification for the

Expenses in bringing such a suit. Should a court determine that the Indemnified Parties acted in a manner which would not permit indemnification, the Company will not be liable for failure to make an indemnification payment.

Advancement and Repayment of Expenses

The Agreements obligate the Company to pay the Expenses incurred by the Indemnified Parties in defending and investigating any legal proceeding prior to the final disposition of the legal proceeding, so long as the Indemnified Parties agree to repay any amount for which it is later determined that the Indemnified Parties are not entitled. The Company shall not be required to make any advance to the Indemnified Parties if the Board of Directors determines that it does not appear that the Indemnified Parties have acted in a manner which permits the Company to indemnify the Indemnified Parties and the advancement of Expenses would not be in the best interests of the Company and its shareholders. The Indemnified Parties are required to repay to the Company the amounts advanced only to the extent that a court ultimately determines that he/she is not entitled to indemnification by the Company.

Notice to Bank by Indemnified Parties

In order for the Indemnified Parties to receive indemnification, they must give written notice to the Company within thirty (30) days after they become aware of any claim against them for which they believe indemnification will be sought.

Maintenance of Liability Insurance

The Agreements require that the Company use its best efforts to obtain and maintain in full force and effect directors’ and officers’ liability insurance.

Term

All agreements and obligations of the Company contained in the Agreements shall continue during the period the Indemnified Parties serve as a director or officer of the Company and shall continue thereafter so long as the Indemnified Parties shall be subject to any possible proceeding by reason of the fact that the Indemnified Parties served in such capacity.

Board of Directors’ Recommendation and Required Vote

The affirmative vote of a majority of the votes cast at the meeting, at which a quorum is present, either in person or by proxy, is required to approve this proposal. If you hold your shares in your own name and abstain from voting on this matter, your abstention will have no effect on the vote. If you hold your shares through a broker and you do not instruct the broker on how to vote on this proposal, your broker will not have the authority to vote your shares. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum, but will not have any effect on the outcome of the proposal.

For the reasons set forth above, the Board believes that the Agreements are in the best interest of the Company and its shareholders.

Your Board of Directors unanimously recommends that the shareholders vote “FOR” Proposal 3, the ratification of the indemnification agreements.

PROPOSAL 4 ADVISORY VOTE ON EXECUTIVE COMPENSATION Pursuant to the compensation disclosure rules of the SEC, the Board of Directors is submitting for shareholder approval, on an advisory basis, the compensation paid to the Company’s named executive officers as described in the

Compensation Discussion and Analysis and the tabular disclosure regarding executive compensation (together with the accompanying narrative disclosure) above. As previously disclosed by the Company, the Board of Directors has determined, and the shareholders have agreed, that it will hold an advisory vote on executive compensation on an annual basis. This proposal, commonly known as a “say-on-pay” proposal, gives the Company’s shareholders the opportunity to endorse or not endorse the Company’s executive pay program and policies, and to express their views on the compensation of our Named Executive Officers as disclosed herein. This vote shall not be binding on the Board of Directors or the Compensation Committee and will not be construed as overruling a decision by, nor create or imply any additional fiduciary duty by, the Board or the Compensation Committee. Furthermore, because this non-binding advisory vote relates primarily to compensation that has already been paid or contractually committed for the Company’s named executive officers, there is generally no opportunity for the Board to revisit those decisions. However, the Compensation Committee intends to take into account the outcome of the vote when considering future executive compensation arrangements. Board of Directors’ Recommendation and Required Vote The Board of Directors and the Compensation Committee believe that the Company’s compensation practices and procedures are (i) designed to accomplish the objectives stated in the Company’s compensation philosophy; (ii) competitive, reasonable and effective; and (iii) appropriately aligned with the long-term success of the Company and the interests of its shareholders. This proposal will be approved if the votes cast in favor exceed the votes cast against it. Your Board of Directors unanimously recommends a vote “FOR” approval of the compensation of our Named Executive Officers as disclosed in this proxy statement pursuant to the disclosure rules of the SEC. PROPOSAL 5 ADVISORY VOTE ON THE FREQUENCY OF HOLDING AN ADVISORY VOTE ON EXECUTIVE COMPENSATION SEC Disclosure rules also enable shareholders to approve, on an advisory non-binding basis, the frequency of the advisory vote on the compensation of our Named Executive Officers, as described in Proposal 4, above. Accordingly, shareholders may indicate whether they would prefer an advisory vote on such executive compensation once every one, two, or three years, or whether they wish to abstain from casting a vote. After considering the benefits and consequences of each option for the frequency of advisory say-on-pay votes, our Board has determined that an advisory vote on executive compensation that occurs every year is the most appropriate approach for the Company. The Board believes that current corporate practices and governance trends favor an annual advisory vote. This gives shareholders the opportunity to react promptly to emerging trends in compensation, and gives the Board and the Compensation Committee the opportunity to evaluate compensation decisions in light of yearly feedback from shareholders. As an advisory vote, the result will not be binding upon the Company, although the Compensation Committee and the Board of Directors value the opinions expressed by shareholders and will certainly give consideration to the frequency option that receives the highest number of shareholder votes. Shareholders are not being asked to approve or disapprove the Board’s recommendation, but rather to indicate their choice among the frequency options. Please mark on the Proxy Card your preference as to the frequency of holding shareholder advisory votes on executive compensation, as every one, two or three years, or mark “abstain” on this proposal. PROPOSALS OF SHAREHOLDERS Under certain circumstances, shareholders are entitled to present proposals at shareholder meetings. Any such proposal concerning our 20222024 Annual Meeting of Shareholders must be submitted by a shareholder prior to December 15, 2021,16, 2023, in order to qualify for inclusion in the proxy statement relating to such meeting. The submission by a shareholder of a proposal does not guarantee that it will be included in the proxy statement. Shareholder proposals are subject to certain regulations and requirements under federal securities laws. The persons named as proxies for the 20222024 Annual Meeting of Shareholders will have discretionary authority to vote on any shareholder proposal which is not included in our proxy materials for the meeting, unless we receive notice of the proposal by March 1, 2022.2024. If we receive proper notice by that date, the proxy holders will not have discretionary voting authority except as provided in federal regulations governing shareholder proposals.

OTHER MATTERS Management does not know of any matters to be presented to the Meeting other than those set forth above. However, if other matters properly come before the Meeting, it is the intention of the proxy holders to vote said Proxy in accordance with the recommendations of your Board of Directors, and authority to do so is included in the Proxy. DATED: April 15, 202113, 2023 | SIERRA BANCORP

Kevin J. McPhaill

President and Chief Executive Officer |

A COPY OF THE COMPANY’S 20202022 ANNUAL REPORT ON FORM 10-K INCLUDING FINANCIAL STATEMENTS (BUT WITHOUT EXHIBITS) FILED WITH THE SEC IS INCLUDED AS PART OF THE COMPANY’S ANNUAL REPORT TO SHAREHOLDERS WHICH IS BEING PROVIDED TO SHAREHOLDERS TOGETHER WITH THIS PROXY STATEMENT. IF A SHAREHOLDER DESIRES COPIES OF THE EXHIBITS TO THE REPORT, THEY WILL BE PROVIDED UPON PAYMENT BY THE SHAREHOLDER OF THE COST OF FURNISHING THE EXHIBITS TOGETHER WITH A WRITTEN REQUEST TO CHRISTOPHER G. TREECE, EXECUTIVE VICE PRESIDENT AND CHIEF FINANCIAL OFFICER, AT 86 NORTH MAIN STREET, PORTERVILLE, CALIFORNIA 93257.

APPENDIX A

INDEMNIFICATION AGREEMENT

This Indemnification Agreement, dated as of January 28, 2021, is made by and among Sierra Bancorp, a California corporation, Bank of the Sierra, a California banking corporation (Sierra Bancorp and Bank of the Sierra being collectively referred to as the “Corporation”), and a director or officer of either Sierra Bancorp or Bank of the Sierra (the “Indemnitee”).

RECITALS

A.The Corporation and the Indemnitee recognize that the present state of the law is too uncertain to provide the Corporation’s officers and directors with adequate and reliable advance knowledge or guidance with respect to the legal risks and potential liabilities to which they may become personally exposed as a result of performing their duties for the Corporation;

B.The Corporation and the Indemnitee are aware of the substantial growth in the number of lawsuits filed against corporate officers and directors in connection with their activities in such capacities and by reason of their status as such;

C.The Corporation and the Indemnitee recognize that the cost of defending against such lawsuits, whether or not meritorious, is typically beyond the financial resources of most officers and directors of the Corporation;

D.The Corporation and the Indemnitee recognize that the legal risks and potential liabilities, and the threat thereof, associated with proceedings filed against the officers and directors of the Corporation bear no reasonable relationship to the amount of compensation received by the Corporation’s officers and directors;

E.The Corporation has determined that the liability insurance coverage available to the Corporation as of this date may not be entirely adequate. The Corporation believes, therefore, that the interest of the Corporation’s shareholders would be best served by a combination of (i) such insurance as the Corporation may obtain pursuant to the Corporation’s obligations hereunder and (ii) a contract with its officers and directors, including the Indemnitee, to indemnify them to the fullest extent permitted by law (as in effect on the date hereof, or, to the extent any amendment may expand such permitted indemnification, as hereafter in effect) against personal liability for actions taken in the performance of their duties to the Corporation;

F.Section 317 of the California Corporations Code empowers California corporations to indemnify their officers and directors and further states that the indemnification provided by Section 317 “shall not be deemed exclusive of any other rights to which those seeking indemnification may be entitled under any bylaw, agreement, vote of shareholders or disinterested directors or otherwise, both as to action in an official capacity and as to action in another capacity while holding such office, to the extent such additional rights to indemnification are authorized in the articles of the corporation”; thus, Section 317 does not by itself limit the extent to which the Corporation may indemnify persons serving as its officers and directors;

G.The Corporation’s Articles of Incorporation and Bylaws authorize the indemnification of the officers and directors of the Corporation in excess of that expressly permitted by Section 317, subject to the limitations set forth in Section 204(a)(11) of the California Corporations Code;

H.The Board of Directors of the Corporation has concluded that, to retain and attract talented and experienced individuals to serve as officers and directors of the Corporation and to encourage such individuals to take the business risks necessary for the success of the Corporation, it is necessary for the Corporation to contractually indemnify its officers and directors, and to assume for itself liability for expenses and damages in connection with claims against such officers and directors in connection with their service to the Corporation, and has further concluded that the failure to provide such contractual indemnification could result in great harm to the Corporation and its shareholders;

I.The Corporation desires and has requested Indemnitee to serve or continue to serve as a director or officer of the Corporation, free from undue concern for the potential liabilities associated with such services to Corporation; and

J.The Indemnitee is willing to serve, or continue to serve, the Corporation, provided, and on the expressed condition, that the indemnification provided for herein is furnished by the Corporation.

AGREEMENT

NOW, THEREFORE, the Corporation and Indemnitee agree as follows:

1.Definitions.

(a) “Agent” means any person who is or was acting in his capacity as a director or officer of the Corporation, or is or was serving as a director, officer, employee or agent of any other enterprise at the request of the Corporation, and whether or not the person is serving in any such capacity at the time any liability or expense is incurred for which indemnification or reimbursement can be provided under this Agreement.

(b) “Applicable Standard” means that a person acted in good faith and in a manner such person reasonably believed to be in the best interests of the Corporation; except that in a criminal proceeding, such person must also have had no reasonable cause to believe that such person’s conduct was unlawful. The termination of any Proceeding by judgment, order, settlement, conviction or upon plea of nolo contendere or its equivalent shall not, of itself, create any presumption, or establish, that the person did not meet the “Applicable Standard.”

(c) “Expenses” means, for the purposes of this Agreement, all direct and indirect costs of any type or nature whatsoever (including, without limitation, any fees and disbursements of Indemnitee’s counsel, accountants and other experts and other out-of-pocket costs) actually and reasonably incurred by the Indemnitee in connection with the investigation, preparation, defense or appeal of a Proceeding; provided, however, that Expenses shall not include judgments, fines, penalties or amounts paid in settlement of a Proceeding.

(d) “Proceeding” means, for the purposes of this Agreement, any threatened, pending or completed action or proceeding, whether civil, criminal, administrative or investigative (including an action brought by or in the right of the Corporation) in which Indemnitee may be or may have been involved as a party or otherwise, by reason of the fact that Indemnitee is or was a director or officer of the Corporation, or is or was a director or officer of any subsidiary of the Corporation, by reason of any action taken by Indemnitee or of any inaction on Indemnitee’s part while acting as such director or officer or by reason of the fact that the person is or was serving at the request of the Corporation as a director, officer, employee or agent of another foreign or domestic corporation, partnership, joint venture, trust or other enterprise, or was a director and/or officer of the foreign or domestic corporation which was a predecessor corporation to the Corporation or of another enterprise at the request of such predecessor corporation, whether or not the person is serving in such capacity at the time any liability or expense is incurred for which indemnification or reimbursement can be provided under this Agreement.

2.Agreement to Serve. In consideration of the protection afforded by this Agreement, if Indemnitee is a director of the Corporation, the director agrees to serve at least for the balance of the current term as a director and not to resign voluntarily during such period without the written consent of a majority of the remaining directors. If Indemnitee is an officer of the Corporation not serving under an employment contract, the officer agrees to serve in such capacity at least for the balance of the current fiscal year of the Corporation and not to resign voluntarily during such period without the written consent of a majority of the Board of Directors. Following the applicable period set forth above, Indemnitee agrees to serve or continue to serve in such capacity to the best of the person’s abilities at the will of the Corporation or under separate contract, if such contract exists, for so long as Indemnitee is duly elected or appointed and qualified or until such time as the person tenders their resignation in writing. Nothing contained in this Agreement is intended to create in Indemnitee any right to continued employment.

3.Indemnification.

(a) Third Party Proceedings. The Corporation shall indemnify Indemnitee against Expenses, judgments, fines, penalties or amounts paid in settlement (if the settlement is approved in advance by the Corporation, which approval shall not be unreasonably withheld) actually and reasonably incurred by Indemnitee in connection with a Proceeding (other than a Proceeding by or in the right of the Corporation) if Indemnitee acted in good faith and in a manner Indemnitee reasonably believed to be in the best interests of the Corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe Indemnitee's conduct was unlawful. The termination of any Proceeding by judgment, order, settlement, conviction, or upon a plea of nolo contendere or its equivalent, shall not, of itself, create a presumption that Indemnitee did not act in good faith and in a manner which Indemnitee reasonably believed to be in the best interests of the Corporation, or, with respect to any criminal Proceeding, had no reasonable cause to believe that Indemnitee’s conduct was unlawful.

(b)Proceedings By or in the Right of the Corporation. The Corporation shall indemnify Indemnitee if Indemnitee is made a party to, or threatened to be made a party to, or otherwise involved in, any Proceeding which is an action by or in the right of the Corporation to procure a judgment in its favor by reason of the fact that Indemnitee is or was an Agent of the Corporation. This indemnity shall apply, and be limited, to and against all expenses actually and reasonably incurred by Indemnitee in connection with the defense or settlement of such Proceeding, but only if: (a) Indemnitee met the Applicable Standard (except that the Indemnitee’s belief regarding the best interests of the Corporation need not have been reasonable); (b) Indemnitee also acted in a manner which the person believed to be in the best interests of the Corporation’s shareholders; and (c) the action is not settled or otherwise disposed of without court approval. No indemnification shall be made under this section 3 in respect of any claim, issue or matter as to which Indemnitee shall have been adjudged to be liable to the Corporation in the performance of such person’s duty or the Corporation, unless, and only to the extent that, the court in which such proceeding is or was pending shall determine upon application that, in view of all the circumstances of the case, Indemnitee is fairly and reasonable entitled to indemnification for the expenses which such court shall determine.

(c) Scope. Notwithstanding any other provision of this Agreement but subject to Section 14(b), the Corporation shall indemnify the Indemnitee to the fullest extent permitted by law, notwithstanding that such indemnification is not specifically authorized by other provisions of this Agreement, the Corporation's Articles of Incorporation, the Corporation's Bylaws or by statute.

4.Limitations on Indemnification. Any other provision herein to the contrary notwithstanding, the Corporation shall not be obligated pursuant to the terms of this Agreement:

(a)Excluded Acts. To indemnify Indemnitee for any acts or omissions or transactions from which a director or officer may not be relieved of liability under the California General Corporation Law or for expenses, penalties, or other payments prohibited by Part 359 of the FDIC’s Rules and Regulations, incurred in an administrative proceeding or action instituted by an appropriate bank regulatory agency which proceeding or action results in a final order assessing civil money penalties or requiring affirmative action by an individual or individuals in the form of payments to the Corporation or its subsidiary;

(b)Claims Initiated by Indemnitee. To indemnify or advance Expenses to Indemnitee with respect to Proceedings or claims initiated or brought voluntarily by Indemnitee and not by way of defense, except with respect to proceedings brought to establish or enforce a right to indemnification under this Agreement or any other statute or law or otherwise as required under Section 317 of the California General Corporation Law, but such indemnification or advancement of Expenses may be provided by the Corporation in specific cases if the Board of Directors has approved the initiation or bringing of such suit; or

(c)Lack of Good Faith. To indemnify Indemnitee for any Expenses incurred by the Indemnitee with respect to any proceeding instituted by Indemnitee to enforce or interpret this Agreement, if a court of competent jurisdiction determines that each of the material assertions made by the Indemnitee in such proceeding was not made in good faith or was frivolous; or

(d)Insured Claims. To indemnify Indemnitee for Expenses or liabilities of any type whatsoever (including, but not limited to, judgments, fines, ERISA excise taxes or penalties, and amounts paid in settlement) which have been paid directly to or on behalf of Indemnitee by an insurance carrier under a policy of directors’ and officers’ liability insurance maintained by the Corporation or any other policy of insurance maintained by the Corporation or Indemnitee; or

(e)Claims Under Section 16(b). To indemnify Indemnitee for Expenses and the payment of profits arising from the purchase and sale by Indemnitee of securities in violation of Section 16(b) of the Securities Exchange Act of 1934, as amended, or any similar successor statute.

5.Determination of Right to Indemnification.

Upon receipt of a written claim addressed to the Board of Directors for indemnification pursuant to Section 3, the Corporation shall determine by any of the methods set forth in Section 317(e) of the California Corporations Code whether Indemnitee has met the applicable standard of conduct which makes it permissible under applicable law to indemnify Indemnitee. If a claim under Section 3 is not paid in full by the Corporation within ninety (90) days after such written claim has been received by the Corporation, the Indemnitee may at any time thereafter bring suit against the Corporation to recover the unpaid amount of the claim and, unless such action is dismissed by the court as frivolous or brought in bad faith, the Indemnitee shall be entitled to be paid also the expense of prosecuting such claim. It shall be a defense to any such action, other than an action brought to enforce a claim for Expenses incurred in defending any Proceeding (other than a Proceeding brought by the Corporation directly in its own right as distinguished from an action brought derivatively or by any receiver or trustee) in advance of its final disposition where the required undertaking, if any, has been tendered to the Corporation that the Indemnitee has not met the standards of conduct which make it permissible under applicable law to indemnify the Indemnitee for the amount claimed, but the burden of proving such defense, by clear and convincing evidence, shall be on the Corporation. Neither the failure of the Corporation (including its Board of Directors, independent legal counsel, or its shareholders) to make a determination prior to the commencement of such action that indemnification of the Indemnitee is proper in the circumstances because Indemnitee has met the applicable standard of conduct under applicable law, nor an actual determination by the Corporation (including its Board of Directors, independent legal counsel or its shareholders) that the Indemnitee has not met such applicable standard of conduct, shall be a defense to the action or create a presumption that Indemnitee has not met the applicable standard of conduct.

6.Advancement and Repayment of Expenses.

(a)The Expenses incurred by Indemnitee in defending and investigating any Proceeding shall be paid by the Corporation in advance of the final disposition of such Proceeding within 30 days after receiving from Indemnitee the copies of invoices presented to Indemnitee for such Expenses, if Indemnitee shall provide an undertaking to the Corporation to repay such amount to the extent it is ultimately determined that Indemnitee is not entitled to indemnification and a written affirmation as is required by applicable law with respect to Indemnitee’s good faith belief that the standard of conduct necessary for indemnification by the Corporation as authorized by law has been met, whether prior to or after final disposition of any Proceeding. In determining whether or not to make an advance hereunder, the ability of Indemnitee to repay shall not be a factor. Notwithstanding the foregoing, in a proceeding brought by the Corporation directly, in its own right (as distinguished from an action bought derivatively or by any receiver or trustee), the Corporation shall not be required to make the advances called for hereby if the Board of Directors determines, in its sole discretion, that it does not appear that Indemnitee has met the standards of conduct which make it permissible under applicable law to indemnify Indemnitee and the advancement of Expenses would not be in the best interests of the Corporation and its shareholders.

7.Partial Indemnification. If the Indemnitee is entitled under any provision of this Agreement to indemnification or advancement by the Corporation of some or a portion of any Expenses or liabilities of any type whatsoever (including, but not limited to, judgments, fines, penalties, and amounts paid in settlement) incurred by the Indemnitee in the investigation, defense, settlement or appeal of a Proceeding, but is not entitled to indemnification or advancement of the total amount thereof, the Corporation shall nevertheless indemnify or pay advancements to the Indemnitee for the portion of such Expenses or liabilities to which the Indemnitee is entitled.

8.Notice to Corporation by Indemnitee. Indemnitee shall notify the Corporation in writing of any matter with respect to which Indemnitee intends to seek indemnification hereunder as soon as reasonably practicable following the receipt by Indemnitee of written notice thereof; provided that any delay in so notifying Corporation shall not constitute a waiver by Indemnitee of his rights hereunder. The written notification to the Corporation shall be addressed to the Board of Directors and shall include a description of the nature of the Proceeding and the facts underlying the Proceeding and be accompanied by copies of any documents filed with the court in which the Proceeding is pending. In addition, Indemnitee shall give the Corporation such information and cooperation as it may reasonably require and as shall be within Indemnitee's power.

No costs, charges or expenses for which indemnity shall be sought hereunder shall be incurred without the Corporation’s consent, which consent shall not be unreasonably withheld.

9.Maintenance of Liability Insurance.

(a)The Corporation hereby agrees that so long as Indemnitee shall continue to serve as a director or officer of the Corporation and thereafter so long as Indemnitee shall be subject

to any possible Proceeding, the Corporation, subject to Section 9(b), shall use its best efforts to obtain and maintain in full force and effect directors’ and officers’ liability insurance (“D&O Insurance”) which provides Indemnitee the same rights and benefits as are accorded to the most favorably insured of the Corporation’s directors, if Indemnitee is a director; or of the Corporation’s officers, if Indemnitee is not a director of the Corporation but is an officer.

(b)Notwithstanding the foregoing, the Corporation shall have no obligation to obtain or maintain D&O Insurance if the Corporation determines in good faith that such insurance is not reasonably available, the premium costs for such insurance are disproportionate to the amount of coverage provided, the coverage provided by such insurance is limited by exclusions so as to provide an insufficient benefit, or the Indemnitee is covered by similar insurance maintained by a subsidiary or parent of the Corporation.

(c)Notice to Insurers. If, at the time of the receipt of a notice of a claim pursuant to Section 8 hereof, the Corporation has D&O Insurance in effect, the Corporation shall give prompt notice of the commencement of such Proceeding to the insurers in accordance with the procedures set forth in the respective policies. The Corporation shall thereafter take all necessary or desirable action to cause such insurers to pay, on behalf of the Indemnitee, all amounts payable as a result of such Proceeding in accordance with the terms of such policies.

10.Defense of Claim. In the event that the Corporation shall be obligated under Section 6 hereof to pay the Expenses of any Proceeding against Indemnitee, the Corporation, if appropriate, shall be entitled to assume the defense of such Proceeding, with counsel approved by Indemnitee, which approval shall not be unreasonably withheld, upon the delivery to Indemnitee of written notice of its election to do so. After delivery of such notice, approval of such counsel by Indemnitee and the retention of such counsel by the Corporation, the Corporation will not be liable to Indemnitee under this Agreement for any fees of counsel subsequently incurred by Indemnitee with respect to the same Proceeding, provided that (i) Indemnitee shall have the right to employ his counsel in any such Proceeding at Indemnitee’s expense; and (ii) if (a) the employment of counsel by Indemnitee has been previously authorized by the Corporation, or (b) Indemnitee shall have reasonably concluded that there may be a conflict of interest between the Corporation and the Indemnitee in the conduct of such defense or (c) the Corporation shall not, in fact, have employed counsel to assume the defense of such Proceeding, then the fees and expenses of Indemnitee's counsel shall be at the expense of the Corporation.

11.Attorneys’ Fees.

(a)In the event that Indemnitee or the Corporation institutes an action to enforce or interpret any terms of this Agreement, the Corporation shall reimburse Indemnitee for all of the Indemnitee's reasonable fees and expenses in bringing and pursuing such action or defense, unless as part of such action or defense, a court of competent jurisdiction determines that the material assertions made by Indemnitee as a basis for such action or defense were not made in good faith or were frivolous.

(b)Any controversy or claim arising out of or relating to the interpretation of the amount of an Indemnitee “reasonable” fees and expenses pursuant to this Section 11 or elsewhere in this Agreement may, at the election of Indemnitee, be finally settled by arbitration in accordance with the rules of the American Arbitration Association (with no right to a jury trial or appellate review), and judgment upon the award rendered by the arbitrator may be rendered in any court having jurisdiction thereof. The arbitration shall be conducted in Tulare County, California in accordance with the ADR Service Provider’s then current rules for arbitration of business disputes by a panel of three arbitrators (with each party selecting one arbitrator and those two selecting the third). The arbitration shall be governed by the United States Arbitration Act, 9 U.S.C. Sections 1-16 (as may be amended). In no event shall a claim be arbitrated that would be barred by the statute of limitations in a judicial proceeding.

12.Continuation of Obligations. All agreements and obligations of the Corporation contained herein shall continue during the period the Indemnitee is a director or officer of the Corporation, or is or was serving at the request of the Corporation as a director, officer, fiduciary, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, and shall continue thereafter so long as the Indemnitee shall be subject to any possible proceeding by reason of the fact that Indemnitee served in any capacity referred to herein.

13.Successors and Assigns. This Agreement establishes contract rights that shall be binding upon, and shall inure to the benefit of, the successors, assigns, heirs and legal representatives of the parties hereto.

14.Non-exclusivity.

(a)The provisions for indemnification and advancement of expenses set forth in this Agreement shall not be deemed to be exclusive of any other rights that the Indemnitee may have under any provision of law, the Corporation’s Articles of Incorporation or Bylaws, the vote of the Corporation’s shareholders or disinterested directors, other agreements or otherwise, both as to action in his official capacity and action in another capacity while occupying his position as a director or officer of the Corporation.

(b)In the event of any changes, after the date of this Agreement, in any applicable law, statute, or rule which expand the right of a California corporation to indemnify its officers and directors, the Indemnitee's rights and the Corporation’s obligations under this Agreement shall be expanded to the full extent permitted by such changes. In the event of any changes in any applicable law, statute or rule, which narrow the right of a California corporation to indemnify a director or officer, such changes, to the extent not otherwise required by such law, statute or rule to be applied to this Agreement, shall have no effect on this Agreement or the parties' rights and obligations hereunder.

15.Effectiveness of Agreement. To the extent that the indemnification permitted under the terms of certain provisions of this Agreement exceeds the scope of the indemnification provided for in the California General Corporation Law, such provisions shall not be effective unless and until the Corporation’s Articles of Incorporation authorize such additional rights of indemnification. In all other respects, the balance of this Agreement shall be effective as of the date set forth on the first page and may apply to acts of omissions of Indemnitee which occurred prior to such date if Indemnitee was an officer, director, employee or other agent of the Corporation, or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, at the time such act or omission occurred.

16.Severability. Nothing in this Agreement is intended to require or shall be construed as requiring the Corporation to do or fail to do any act in violation of applicable law. The Corporation’s inability, pursuant to court order or pursuant to Part 359 of the FDIC’s Rules and Regulations, to perform its obligations under this Agreement shall not constitute a breach of this Agreement. The provisions of this Agreement shall be severable as provided in this Section 16. If this Agreement or any portion hereof shall be invalidated on any ground by any court of competent jurisdiction, then the Corporation shall nevertheless indemnify Indemnitee to the full extent permitted by any applicable portion of this Agreement that shall not have been invalidated, and the balance of this Agreement not so invalidated shall be enforceable in accordance with its terms.

17.Governing Law. This Agreement shall be interpreted and enforced in accordance with the laws of the State of California. To the extent permitted by applicable law, the parties hereby waive any provisions of law which render any provision of this Agreement unenforceable in any respect.

18.Notice. All notices, requests, demands and other communications under this Agreement shall be in writing and shall be deemed duly given (i) if delivered by hand and receipted for by the party addressee or (ii) if mailed by certified or registered mail with postage prepaid, on the third business day after the mailing date. Addresses for notice to either party are as shown on the signature page of this Agreement, or as subsequently modified by written notice.

19.Mutual Acknowledgment. Both the Corporation and Indemnitee acknowledge that in certain instances, federal law or applicable public policy may prohibit the Corporation from indemnifying its directors and officers under this Agreement or otherwise. Indemnitee understands and acknowledges that the Corporation has undertaken or may be required in the future to undertake with the Securities and Exchange Commission to submit the question of indemnification to a court in certain circumstances for a determination of the Corporation's right under public policy to indemnify Indemnitee.

20.Counterparts. This Agreement may be executed in one or more counterparts, each of which shall constitute an original.

21.Limitation of Action. To extent that Indemnitee is solely a director or officer of Sierra Bancorp or Corporation of the Sierra and not both, any obligation to Indemnitee hereunder shall be limited to only the entity of which Indemnitee is an officer or director and the other entity shall have no obligation to Indemnitee hereunder.

22.Amendment and Termination. No amendment, modification, termination or cancellation of this Agreement shall be effective unless in writing signed by both parties hereto.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the day and year set forth above.

SIERRA BANCORP

By: _____________________________

Title: ____________________________

Address: 90 North Main Street

Porterville, California 93257